Why should you use the Zucchetti integration?

Zucchetti allows you to quickly pass information over employees' absences to your bookkeeper, saving time on manual work. Zucchetti is an integration that works in the domain of payroll.

How to set up the integration?

Zucchetti integration works for employees with fixed contracts with a number of hours that is equal every week (e.g. 40 hours per week). Your bookkeeper needs to store the theoretical working hours of your employees into Zucchetti and would also need to make sure that during the import phase ("Importa Movimenti Paga da esterno") the option "Completamento del teorico con ore lavorate" is flagged in the "Rilevatore Presenze".

- Head to Marketplace → Integrations

- Scroll down till you find Zucchetti

- Press on Install app

- Head to Settings

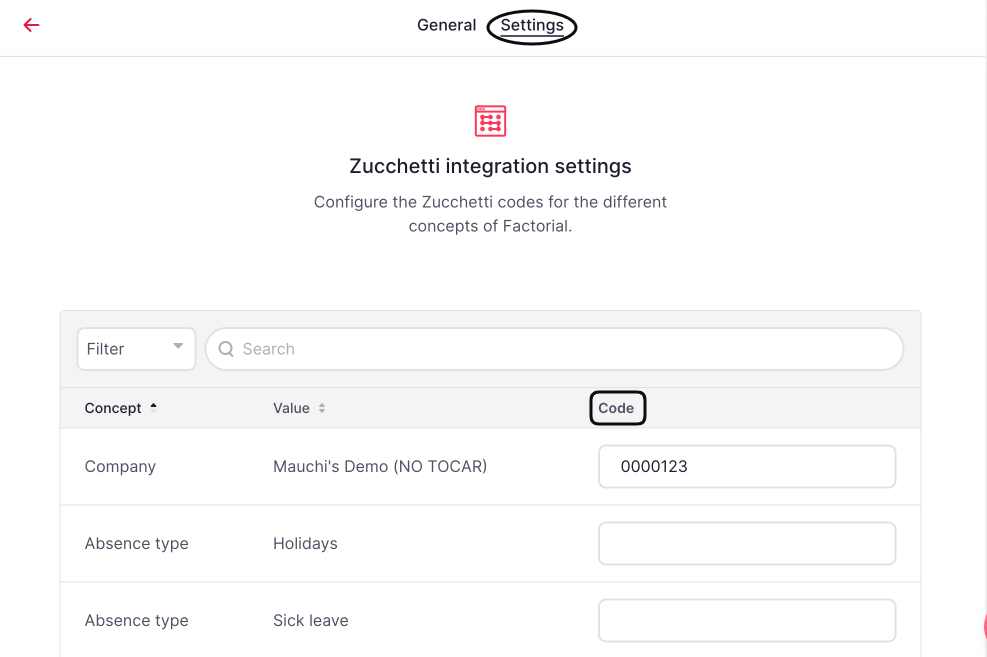

Through Settings, you will be able to configure and assign Zucchetti codes.

Administrators must activate the Zucchetti integration through the app section to be able to map absences types (sick leaves and holidays) with Zucchetti corresponding codes. Administrators can insert all this information down here.

A company code in Zucchetti has this format: 0000123 (7 figures). 0s should always be included. Please ask your bookkeeper to provide the following codes:

- Zucchetti Company Code

- Zucchetti Employee Codes

- Zucchetti Absence Codes

Add Zucchetti Codes

You need to fill the tables with the codes provided by your bookkeeper. The first row is related to the Company's Zucchetti Code. Please note that if you don't want to export a specific absence to Zucchetti you need to leave the field empty.

Example:

- Sick Leave - Absence code : MA

- Holidays - Absence code : FE

Configuring Employee Codes

An employee code in Zucchetti has 6 figures (000002). 0s should be included.

When the integration is installed, a new Zucchetti code field will be available in the Personal Data of each employee. This will allow admins to individually manage Zucchetti codes.

- Head to Organisation

- Select the employee in question

- Head to Personal tab

- Scroll until you find Payroll Information

- Insert the code provided by the bookkeeper into Zucchetti Employee Code

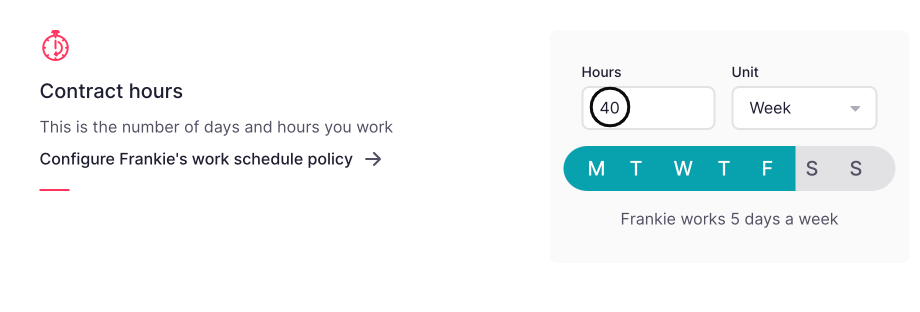

Contract Hours

Zucchetti calculates theoretical hours which refers to the hours employees work per week. The calculation of time off is done based on the theoretical hours employees should have worked.

Example: Frankie works 40 hours per week across 5 days = 8 hours per day.

Frankie decides to take half-day off on April 1st. Factorial will export in the Zucchetti .xml file, 4 hours of holiday (1 day) on April 1st.

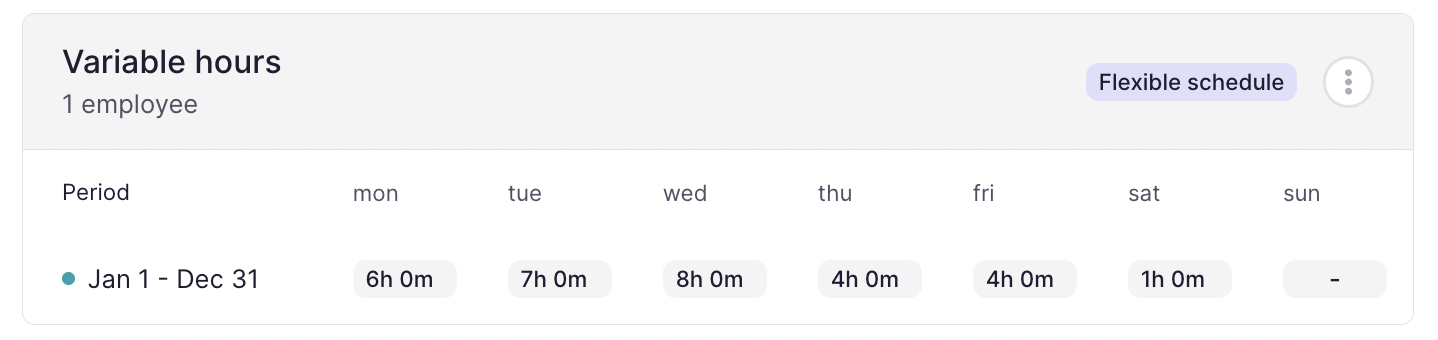

For employees with variable daily working hours (e.g. Monday -> 6 hours, Tuesday -> 7 hours), it will be necessary to set the daily working hours in the "Work schedules" section in order to correctly calculate the absence requests.

Accessing Compensation Reports

In order to download the Zucchetti report, you must install the Payroll App.

- Head to Compensation

- Select Download Payroll Data on the upper right of the page

- Click on Payroll export format

- Find Zucchetti - Absences

- Press on Download

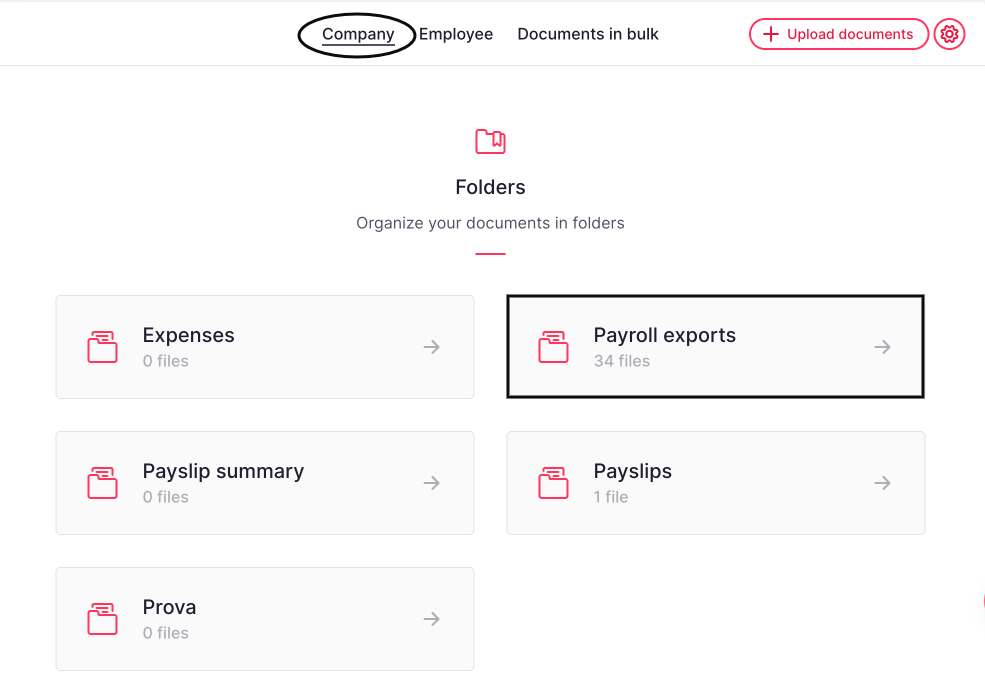

Where can I find the Downloaded Data?

The download of a .xml file will start automatically for companies with less than 50 employees and it will be saved in the Compensation export folder. For companies with more than 50 employees you will receive an email with the report attached to it.

- Head to Files

- Head to Company

- Click the Payroll Export Folder

Email Notifications

When a payroll report is sent by email, the Zucchetti the .xml file will be attached to the email.

Attendance and absence reports in Excel format

We recommend that you send your consultant, together with the Zucchetti report in .xml format, an attendance and absence report on Excel to make sure that all the data to be processed are correct for payroll purposes.